Will the move to a low-carbon economy prove to be a boon for green bonds?

- 08 January 2019 (5 min read)

Despite the US administration’s headline-grabbing decision to pull out of the Paris Climate Accord, the initiative’s key pledge to maintain global temperatures ‘well below’ 2°C, above pre-industrial levels remains firmly in place.

Since it was established at the 2015 UN Climate Change Conference – also known as COP 21 – it has helped countries transition towards a low-carbon economy and kick-started a wave of regulatory change, increasing investment awareness of environmental issues.

Growing environmental concerns have helped the green bond market expand rapidly in recent years

Green bonds, which were developed to finance projects specifically targeting a positive environmental impact, benefitted from this commitment. They enable companies to emphasise their climate-friendly projects, and can widen a company’s investor base, as issuances usually experience stronger demand than standard bonds. In addition, many international investors committed to disclose their investments’ carbon footprint by signing the 2016 Montreal Carbon Pledge, including AXA Group. In this context, the opportunity provided by green bonds to invest in projects targeting environmental benefits, without taking on additional risk, was particularly appealing.

Now, regulatory pressures are also mounting to ensure that asset managers report on environmental issues and more broadly take into account ESG (Environment, Social, Governance) criteria. But this regulatory incentive has enabled ESG investment gain to momentum.

But this growth would not have been possible without well-established actors such as the Green Bond Principles or the Climate Bond Initiative. These organisations have developed progressively since the first green bond issuance in 2007 and steadily released guidance and standards, which now help issuers and investors enter this market.

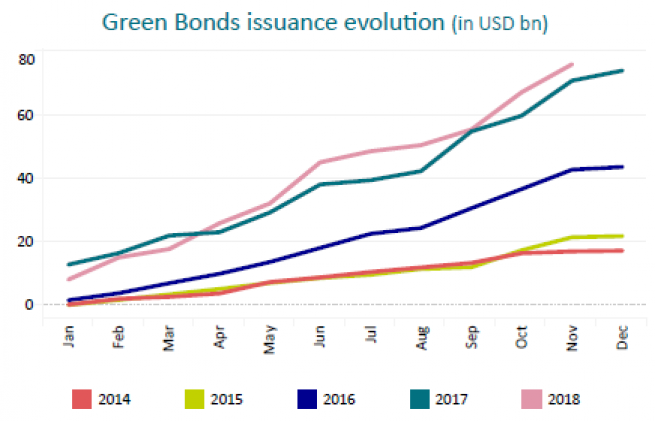

The capital expenditure needed to make the global transition towards a low-carbon economy is huge, which is helping to support the ongoing momentum – indeed, the overall investment universe has grown from a relatively small $36bn in 2015, to approximately $235bn, as at the end of November1 .

The benefits of green bonds

Green bond issuers are expected to clearly identify the projects that they will finance upfront, and provide reports that monitor each projects’ environmental benefit. This transparency of proceeds is a key feature of green bonds as it enables investors to assess the positive impact of their investment and to measure their performance beyond just financial returns.

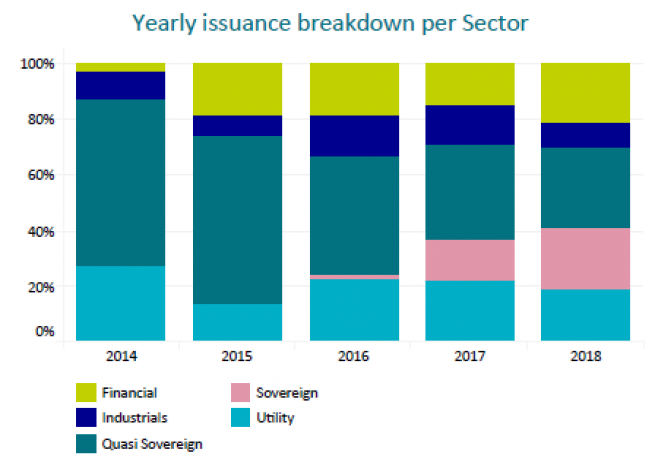

Nonetheless, the benefits of the green bond market go beyond transparency and environmental deliverables. As the overall market has expanded, so too has the diversity of issuers, regions and sectors available to investors. Many sovereign issuers have emerged over the past year, with France and Poland opening the way in 2017, and subsequently Belgium and Indonesia in 2018.

Notably studies show that the green bond market provided a slightly better risk-adjusted return than the global broad market over the past few years.2

Investors might have been concerned that their positive environmental impact may mean sacrificing returns. This raises the question of green bond valuations. Market pricing typically reflects the financial risk of an issuer, and the risk of an individual green bond remains at the issuer level – just like a standard bond. This is why we do not see any difference on issuance price or financial performance between a green and a plain vanilla bond. We believe that this allows investors to include green bonds in their portfolio without taking on additional risk or paying a higher price.

However, as with all investments, green bonds carry risks – and investors may not get back their original capital. The risks associated with green bonds generally reflect those of the wider bond market – they include issuers potentially defaulting on their obligations or having their credit rating downgraded. Certain management strategies involve specific risks, such as liquidity risk, credit risk, counterparty risk, legal risk, valuation risk, operational risk and risks related to the underlying assets.

Harmonization of market practices is still needed

The number of green bond issuers is still relatively low compared to the standard bond market. If we expect more issuers to adopt this form of financing, we believe there needs to be some sort of incentive to entice firms to issue green bonds, such as mitigating the cost that they bear when doing so, which can include the costs of reporting and auditing data.

Additionally, with no compulsory international taxonomy for what constitutes a green bond, nor common regulation, there is the potential for issuers to make misleading claims about how environmentally responsible they are – often referred to as ‘green washing’. In this context, strong analytical capabilities are still required to distinguish between green bonds and regulators could help make this market more accessible.

Europe is pushing forward in developing a common standard for green bonds, which could definitely boost the instrument further. Yet, as of now, a lot remains to be done to get there and investors will have to continue to cope with this blurred line differentiating what’s green and what’s not. That is why at AXA IM, we invested in internal qualitative analysis capabilities to ensure all green bonds we invest in are respecting a high level of environmental standards and impact, and have developed our own green bond framework to ensure we invest only in high-quality and truly impactful green bonds.

What does the future hold for green bonds?

The levels of investment required for the world to transition to a low-carbon economy is substantial. The Global Commission on the Economy and Climate estimates a figure of €90bn3 in infrastructure over the next 15 years. At AXA IM, we believe that new issuers will continue to come to market, as the need for change is not focused on one or two industries but has a vast social and environmental reach.

In this context, as investor awareness increases and regulations around environment reporting evolve, the rapid growth we have experienced over the past couple of years could be just the beginning.

- [1] Merrill Lynch Green Bond Index as at 30/11/2018

- [2] AXA IM, Bloomberg, Merrill Lynch (ML) as of 29/06/18. Based on analysis of annualised return and volatility metrics of the ML Global Broad Index, ML Global Credit Index and Global Green Index from 31/12/2015 – 30/06/2018

- [3] ] Report from the Global Commission on the Economy and Climate: http://www.worldbank.org/content/dam/Worldbank/document/WEurope/2014/IMF-global-commission-economy-climate.pdf

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date. All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document. Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

This document has been edited by AXA INVESTMENT MANAGERS SA, a company incorporated under the laws of France, having its registered office located at Tour Majunga, 6 place de la Pyramide, 92800 Puteaux, registered with the Nanterre Trade and Companies Register under number 393 051 826. In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

In the UK, this document is intended exclusively for professional investors, as defined in Annex II to the Markets in Financial Instruments Directive 2014/65/EU (“MiFID”). Circulation must be restricted accordingly.