Multi-Asset Investments Views: Hold the line, disinflation isn’t always on time

- 30 April 2024 (7 min read)

KEY POINTS

Our views

April sent financial markets back to the painfully positive correlation of last summer: interest rates rose, depreciating the value of bonds, whilst equities also corrected, offering few places to hide in multi-asset portfolios (although our allocation to commodities was helpful).

Indeed, repeatedly strong prints on US inflation put in question, again, the market narrative that the Federal Reserve (Fed) has finished with monetary tightening and is therefore preparing to cut interest rates in the foreseeable future. As we expressed in previous editions, our positive outlook for risky assets (especially equities) is not predicated on a specific starting date for Fed policy rate cuts but rather on the subsequent path and landing destination for policy.

Similarly, whether we see two or three cuts this year is not material for the equity rally to find another leg higher. Instead, the crucial question in our view is whether we will see any cuts at all. As illustrated in the chart below, the valuation of equities is therefore more closely linked to the volatility in interest rates (similar to the uncertainty around the future trajectory in interest rates) more than to the absolute level of interest rates.

We are mindful of further market volatility in the near term, with fear gaining momentum and with investor positioning having reached elevated levels. Beyond this market wobble, we remain confident that, on balance, monetary tightening is over. Financial conditions have already significantly tightened and were transmitted to private agents (households and small- and medium-sized companies), primarily through bank lending. Although cash-rich, low-debt tech large corporations benefit from unprecedentedly high short-term interest rates on their large savings, small firms and middle-class Americans are not as immune to monetary tightening. Indeed, the US Small Business Optimism Index decreased in March to its lowest level since December 2012 and our own US Credit Research analysts see some signs of stress in the most vulnerable parts of the US economy.

As market participants regain confidence in rate cuts, regardless of the timing, this should translate into lower interest rate volatility, offering additional support for equities. Furthermore, our anticipated expansion in the breadth of equity market performance has begun to materialise which further supports our positive stance.

Meanwhile, the economic situation is quite different in Europe, further amplifying the transatlantic divergence. Disinflation is still on track (with Eurozone headline inflation down to +2.4% in March) and economic activity is more hesitant (growth stalling last quarter). More importantly and in stark divergence from the US, fiscal policy is heading into contraction territory, even though unemployment is rising marginally in large member states (albeit from a cyclical low a year ago).

This explains the much more prudent European Central Bank communication and confirms our expectation of monetary policy loosening by summer. Of course, long-dated euro interest rates suffered in sympathy with US Treasury yields, which we see as adding a valuation argument to the macro one for this trade.

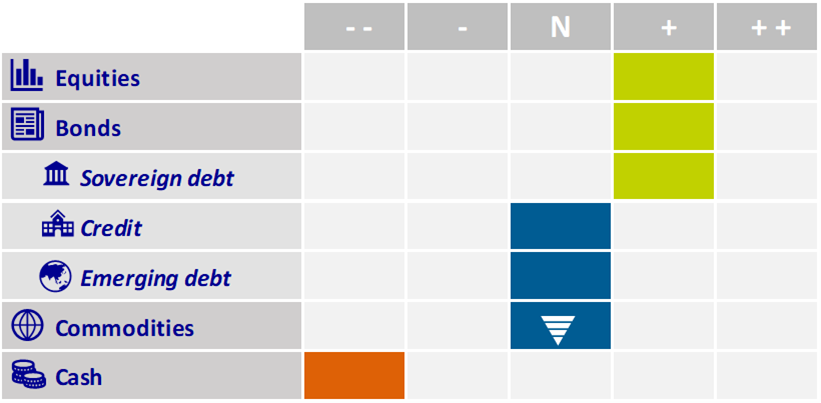

Altogether, our portfolios remain overweight equities, viewing the recent pullback as almost over and not a change of paradigm. We may even consider adding risk later on, if and when we get a downturn in interest rate volatility. Within equities, we maintain our preference for quality but are preparing to add more cyclicality. We also hold on to our duration through Eurozone sovereign debt, whilst we patiently wait to expand into US duration, favouring the front-end of the curve for now (two-year). While significant moves in oil, industrial metals and gold prices now factoring in at least some of the Middle Eastern tensions and early signs of recovery of the Chinese economy, the parallel spike in long positioning prompted us to exit our overweight in commodities.

Equity valuations move in tandem with interest rate volatility

Source: IBES, Bloomberg

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2024 AXA Investment Managers. All rights reserved

Image source: Getty Images