Global Factor Views: US policy uncertainty drives improved outlook for Quality and Low Volatility

- 07 March 2025 (7 min read)

KEY POINTS

US president Donald Trump has been back in the White House for less than two months and he has already deluged the market with a plethora of policy announcements and executive orders. The upshot of his unorthodox, and often rapidly changing position, is that market volatility has markedly risen and the global growth and inflation outlook has become much more uncertain.

The US’s approach to trade and immigration (supply suppressants) combined with plans for lower taxes (a demand stimulant) has in our view created upside inflation risks both in the US and beyond its borders. At present, markets are no longer pricing in a material change to interest rates and as such the interest rate pillar on our factor scorecard is now neutral.

While we still expect solid global economic growth of 3% in 2025, the weaker Institute for Supply Management (ISM) New Orders Index1 (48.6 in February compared to 55.1 in January) is potentially indicative of slower economic momentum. Our macro indicator is based on the level and rate of change of this index – so the decline in new orders means that the macro pillar of our dashboard has moved into a ‘deceleration’ phase.

- VGhlIElTTSBOZXcgT3JkZXIgSW5kZXggbWVhc3VyZXMgdGhlIG51bWJlciBvZiBuZXcgb3JkZXJzIGZyb20gY2xpZW50cyBvZiBtYW51ZmFjdHVyaW5nIGNvbXBhbmllcyByZXBvcnRlZCBieSBzdXJ2ZXkgcmVzcG9uZGVudHMgdmVyc3VzIHRoZSBwcmV2aW91cyBtb250aC4=

Equity factor outlook

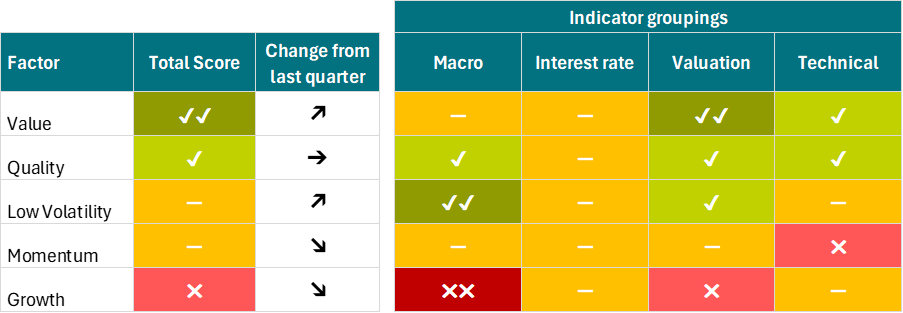

Given the current macro and interest rate backdrop we have updated our Global Factor dashboard – see below

AXA IM Equity Factor Dashboard: March 2025

Source AXA IM, March 2025. ISM macro phase: Deceleration, VIX: High, Interest rate direction: Neutral

Full details of our dashboard methodology can be found here.

In March, Value became the highest-ranking factor on our dashboard while Growth has descended to the bottom due to negative macroeconomic and valuation scores. Low Volatility is the most improved factor, benefiting from increased market risk, attractive valuations and the change to a ‘deceleration’ phase for the macro pillar of our scorecard.

We set out in detail our outlook for equity market factors below.

Value: Positive

Value’s technical indicators are supportive, it is not exhibiting any signs of crowding (i.e. become over popular) or excess volatility. Value - stocks which appear to be trading for less than their underlying value - is by its very nature cheap, but its valuation gap is historically wider than normal. Currently it is at levels which have historically been positive for future outperformance. The most important change in favour of Value compared to the fourth quarter (Q4) of 2024 has been a change in market expectation of the direction of interest rates - from rate cuts to no change.

Quality: Positive

Quality, equities with more consistent earnings growth and typically less share price volatility, tend to outperform when macroeconomic sentiment is in the ‘declaration’ phase of the cycle. The factor’s valuation is at a level that has historically been supportive for future performance. And like all factors in March, Quality received a neutral score on interest rates because the market does not expect any significant changes in monetary policy. Investors should consider an active approach to Quality investing, with a focus on forecast quality that can better capture changing economic conditions.

Low volatility: Neutral

Low Volatility stocks have the most improved score on our dashboard compared with Q4. The factor has benefitted from an increase in market wide risk - represented by a higher volatility index (VIX), and the change to a ‘deceleration’ phase for the macro pillar of our scorecard. Because Low Volatility has been out of favour recently, its valuations are supportive, in particular its forward earnings yield. There are no technical warning signals for Low Volatility at present.

Momentum: Neutral

Momentum - stocks which have had a positive price change relative to the market over the last 12 months - was the highest ranked factor on our dashboard for most of 2024 (with the notable exception of Q3 2024). High price momentum outperformed in 2024, a trend that was underpinned by strong earnings which meant that valuations have remained reasonable, though not cheap. Momentum overall score has deteriorated compared to Q4 however, due to slowing macro momentum. Finally, we continue to observe relatively low levels of performance dispersion within high momentum stocks (i.e elevated crowding), which has historically been a warning signal for the factor.

Growth: Negative

Growth has fallen to the bottom of our factor rankings, because of negative macro and valuation scores. Growth typically underperforms when macro conditions are in the deceleration phase of the cycle, as we are seeing now. Furthermore, Growth as a factor is expensive; while it normally trades at a premium to the market, valuations are at levels which have historically heralded a period of underperformance. Finally, Growth’s overall score has fallen in ranking on our scorecard compared to Q4 last year because the interest rate outlook for the factor has moved from supportive to neutral. Investors should consider an active approach to Growth investing, with a focus on higher quality names underpinned by structural themes.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2025 AXA Investment Managers. All rights reserved

Image source: Getty Images